In the dynamic landscape of packaging solutions, the significance of form and fill machines cannot be overstated. As industries strive for increased efficiency and enhanced productivity, these machines have emerged as pivotal tools in achieving seamless packaging operations. From food and beverages to pharmaceuticals and consumer goods, form and fill machines streamline the process of converting raw materials into ready-to-sell products with precision and speed. This efficiency not only reduces operational costs but also ensures consistent product quality, catering to the growing demands of modern consumers.

In this article, we delve into the top 10 form and fill machines that stand out in delivering exceptional performance and versatility. Each machine brings unique features and capabilities to the table, making them ideal for a variety of packaging needs. We will explore their applications, advantages, and the technological advancements that set them apart. Whether you are a small manufacturer or a large enterprise, understanding the best options available can significantly impact your packaging strategy, leading to improved operational workflows and enhanced market competitiveness. Join us as we navigate through the world of efficient packaging solutions powered by the latest advancements in form and fill machine technology.

In the ever-evolving world of packaging, the importance of form and fill machines cannot be overstated. These machines streamline the packaging process, ensuring efficiency and accuracy while addressing the increasing demands of the market. As companies prioritize sustainability, innovations in form-fill-seal technology are driving significant growth in this sector. The market is projected to reach USD 12.12 billion by 2032, primarily fueled by automation and environmentally friendly solutions.

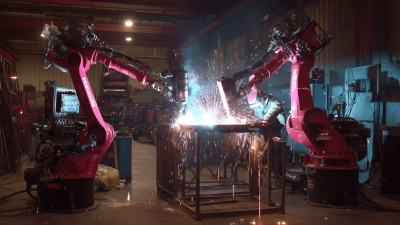

Embracing modern packaging techniques, such as automated sorting and grading, allows businesses to handle larger volumes without compromising quality. For instance, the recent advancements in flexible packaging machinery have enabled companies to enhance their design and manufacturing capabilities while expanding their global reach. Investing in cutting-edge equipment not only meets consumer expectations for efficiency but also aligns with sustainability goals.

Tips: When considering upgrades, evaluate the energy efficiency of new machines to reduce operational costs. Additionally, prioritize equipment that offers flexibility to adapt to various packaging needs. Lastly, stay informed about the latest trends in automation to maintain a competitive edge in the market.

The National Medical Products Administration has recently issued a draft guiding principles for the registration of absorbable intramedullary fixation implants primarily made from synthetic polymer materials. This guidance aims to assist applicants in preparing and drafting the registration documentation for these innovative medical devices. As the demand for absorbable implants continues to grow, driven by advancements in biomaterials and minimally invasive surgical techniques, the industry is witnessing a significant shift towards more effective and safer solutions.

According to a market analysis report, the global absorbable implants market is projected to reach USD 4.5 billion by 2027, with a compound annual growth rate (CAGR) of approximately 8.5% from 2020. Key features that potential applicants should focus on in these registration documents include the mechanical properties of the synthetic polymers, biocompatibility assessments, and evidence of resorbability, which are critical in ensuring the performance and safety of these implants. Additionally, robust clinical data demonstrating efficacy and safety in surgical applications will be essential to meet regulatory expectations and ensure the successful introduction of these products to the market.

The form and fill machine industry is witnessing significant growth, driven by advancements in automation and sustainability. According to recent market research, the global dual chamber syringe (DCS) filling machine market is projected to expand from $365.2 million in 2025 to an impressive $643.0 million in the years following. This growth reflects the increasing demand for efficient packaging solutions across various sectors, particularly in the pharmaceutical and food industries.

Furthermore, the packaging machinery market as a whole is expected to achieve remarkable heights, with a valuation anticipated to reach USD 100.6 billion by 2035. Factors contributing to this growth include the rising trend of automation in manufacturing processes and a growing emphasis on eco-friendly packaging solutions. As companies strive to enhance efficiency while meeting sustainability goals, the adoption of advanced form and fill machines is likely to become a cornerstone in achieving these objectives. The evolving landscape of the packaging machinery market indicates a promising horizon for innovation and investment in this critical industry.

When evaluating form and fill machines for efficient packaging solutions, a comparative analysis of cost efficiency reveals significant variations among different brands. Leading manufacturers have developed diverse models that cater to specific industry needs, each with its unique pricing structures influenced by features, production speed, and maintenance requirements. Brands like Bosch and Viking Masek offer robust designs aimed at high-volume production, yet their initial investment might be higher. In contrast, more budget-friendly options from companies such as Pack Expo provide adequate performance for smaller operations.

Furthermore, operational costs associated with form and fill machines must also be considered when assessing overall cost efficiency. This includes not only purchase price but also factors like energy consumption, labor requirements, and the cost of consumables. For instance, some advanced machines are equipped with automated features that may lower labor costs and decrease downtime, providing long-term savings despite a higher upfront investment. As a result, businesses must evaluate both short-term and long-term financial implications, ensuring they select a packaging solution that aligns with their operational goals and budget constraints.

Form and fill machines have revolutionized the packaging industry, offering businesses a streamlined solution for product packaging. One notable success story is that of a mid-sized snack company that adopted this technology. According to a report by PMMI, the Association for Packaging and Processing Technologies, companies using form and fill systems typically see a 30% reduction in material costs and a significant increase in production speeds—up to 50% in some cases. This particular business reported a remarkable improvement in efficiency and a decrease in labor costs, allowing them to redirect resources towards innovation and product development.

In another case, a beverage manufacturer integrated form and fill machines into their production line, which enabled them to reduce packaging waste by as much as 40%. This shift not only enhanced their sustainability efforts but also appealed to environmentally conscious consumers, resulting in a 15% increase in sales within a year. Industry analysis indicates that the global market for form fill and seal equipment is projected to grow significantly, further prompting businesses to leverage this technology for competitive advantage. These case studies highlight the transformative impact of form and fill machines, showcasing their role in improving operational efficiency and enhancing customer satisfaction.